Reliance Industries Limited (RIL) is one of India’s largest conglomerates with diversified interests across sectors like energy, petrochemicals, telecommunications, retail, and more. Understanding the strengths, weaknesses, opportunities, and threats (SWOT) of Reliance Industries is essential for analyzing its competitive position in the Indian and global markets and strategizing for future growth.

This article provides a comprehensive SWOT analysis of Reliance Industries, exploring its key attributes and market dynamics.

In this blog

Overview of Reliance Industries

Reliance Industries was founded by Dhirubhai Ambani in 1966 as a small textile company. Over the decades, it expanded into various sectors, becoming a leading player in petrochemicals, refining, and oil exploration, among other industries.

Headquartered in Mumbai, Maharashtra, Reliance Industries has become a significant force in India’s economic landscape, with its telecommunications and retail ventures driving substantial growth in recent years.

Quick Stats About Reliance Industries

| Founder | Dhirubhai Ambani |

|---|---|

| Year Founded | 1966 |

| Origin | Mumbai, Maharashtra, India |

| No. of Employees | 230,000+ |

| CEO | Mukesh Ambani |

| Company Type | Public |

| Market Cap | $210 Billion |

| Annual Revenue | $100 Billion (FY 2023) |

| Net Profit | $8 Billion (FY 2023) |

Current News of Reliance Industries

- Jio Platforms Growth: Reliance Jio, the telecommunications arm of RIL, continues to expand its market share in India, becoming the largest telecom operator in the country.

- Retail Expansion: Reliance Retail is aggressively expanding its footprint across India, acquiring brands and opening new stores to capture the growing consumer market.

- Green Energy Initiatives: Reliance is investing heavily in green energy projects, including solar and hydrogen, as part of its strategy to transition towards sustainable energy.

- Strategic Partnerships: RIL has formed alliances with global tech giants like Facebook, Google, and Microsoft to enhance its digital platforms and services.

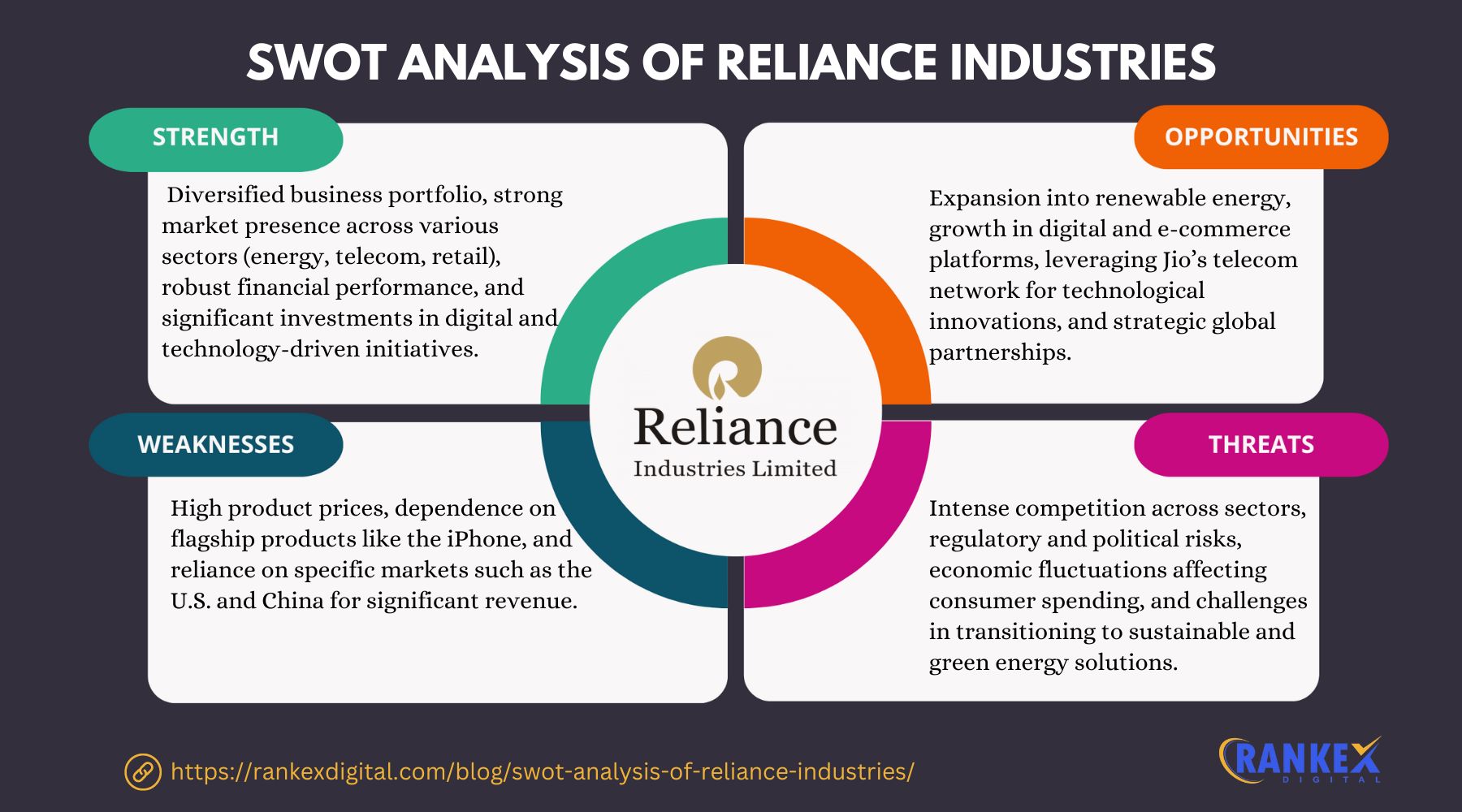

SWOT Analysis of Reliance Industries

Strengths of Reliance Industries

- Diversified Business Portfolio: Reliance Industries operates in various sectors, including energy, retail, telecommunications, and digital services, reducing dependency on any single revenue stream.

- Market Leadership: RIL is a market leader in several sectors, including petrochemicals, refining, and telecommunications, giving it significant influence and competitive advantages.

- Strong Brand Reputation: Reliance is a well-known and trusted brand in India, with a strong legacy and a reputation for innovation and growth.

- Robust Financial Performance: RIL has a strong financial position, with high revenue and profitability, enabling it to invest in new ventures and sustain growth.

- Advanced Technology and Innovation: Through Reliance Jio and its digital initiatives, RIL has positioned itself as a technology leader in India, driving digital transformation across sectors.

Weaknesses of Reliance Industries

- High Debt Levels: RIL’s aggressive expansion strategies have led to high debt levels, which can strain its financial resources and increase vulnerability to economic downturns.

- Dependence on Oil and Gas: A significant portion of RIL’s revenue comes from its oil and gas operations, making it vulnerable to fluctuations in global oil prices and regulatory changes.

- Complex Organizational Structure: RIL’s vast and diversified operations can lead to management challenges, inefficiencies, and slower decision-making processes.

- Limited International Presence: Despite its strong domestic presence, RIL’s international operations are relatively limited, especially outside of the energy sector.

- Regulatory Risks: Operating in multiple sectors exposes RIL to various regulatory risks, including environmental regulations, telecom policies, and retail restrictions.

Opportunities for Reliance Industries

- Expansion in Digital Services: With the increasing digitization of the economy, Reliance can further expand its digital services, leveraging its Jio platform to offer new products and services.

- Growth in Retail Sector: The Indian retail sector is rapidly growing, providing RIL with opportunities to expand its retail footprint and capture a larger market share.

- Green Energy Transition: Reliance’s investments in renewable energy and green technologies position it to benefit from the global shift towards sustainable energy sources.

- Strategic Acquisitions: RIL can continue to grow through strategic acquisitions, both domestically and internationally, to strengthen its position in key markets.

- Global Expansion: By leveraging its expertise in energy, telecommunications, and retail, RIL can explore new markets and expand its global presence, particularly in emerging economies.

Threats to Reliance Industries

- Intense Competition: RIL faces stiff competition across all its sectors, particularly in telecommunications (from Airtel and Vodafone Idea) and retail (from Amazon and Flipkart).

- Economic Slowdown: A slowdown in the Indian or global economy can impact consumer spending, demand for energy, and overall profitability.

- Regulatory Challenges: Changes in government policies, regulations, or taxes can impact RIL’s operations, particularly in sectors like oil and gas, telecommunications, and retail.

- Environmental and Social Risks: RIL’s operations in petrochemicals and refining expose it to environmental and social risks, including activism and stricter environmental regulations.

- Geopolitical Tensions: Reliance’s global operations, particularly in the energy sector, can be affected by geopolitical tensions, trade wars, and international sanctions.

Top Competitors of Reliance Industries

- Bharti Airtel: Competes with Reliance Jio in the telecommunications sector, offering similar services and striving for market leadership.

- Adani Group: A major conglomerate with interests in infrastructure, energy, and logistics, competing with RIL in sectors like renewable energy and natural resources.

- Amazon India: Competes with Reliance Retail in the e-commerce space, offering a wide range of products and services to Indian consumers.

- Indian Oil Corporation: A key competitor in the energy sector, particularly in refining and petrochemicals, with a strong presence in India.

- Tata Group: Competes with RIL across multiple sectors, including retail (Tata Trent), telecommunications (Tata Communications), and energy (Tata Power).

Conclusion

The SWOT analysis of Reliance Industries highlights its diversified business portfolio, market leadership, strong brand reputation, robust financial performance, and advanced technology and innovation as key strengths. However, the company faces challenges such as high debt levels, dependence on oil and gas, complex organizational structure, and regulatory risks.

Opportunities for Reliance Industries lie in the expansion of digital services, growth in the retail sector, green energy transition, strategic acquisitions, and global expansion. On the other hand, threats include intense competition, economic slowdown, regulatory challenges, environmental and social risks, and geopolitical tensions.

By leveraging its strengths and opportunities while addressing its weaknesses and threats, Reliance Industries can continue to be a dominant force in the Indian and global markets and drive future growth.

Frequently Asked Questions

1. What are the strengths of Reliance Industries?

Reliance’s strengths include a diversified business portfolio, strong brand equity, leadership in telecom (Jio), retail, and petrochemicals, along with innovation and a robust infrastructure.

2. What weaknesses does Reliance Industries face?

Reliance’s weaknesses include dependence on the volatile oil sector, a significant debt load, potential operational inefficiencies, and limited agility due to its massive size.

3. What opportunities are available for Reliance Industries?

Key opportunities include expanding digital services through Jio, tapping into India’s growing retail market, international expansion, and investing in renewable energy for sustainability.

4. What threats does Reliance Industries face?

Reliance faces competition in telecom and retail, fluctuations in global oil prices, regulatory changes, and risks from geopolitical tensions and economic downturns.

5. How has Reliance Industries performed in the telecom sector?

Jio, Reliance’s telecom arm, has become the largest telecom operator in India with its affordable data pricing, strong 4G network, and extensive customer base.

6. What is the role of Reliance Industries in the retail sector?

Reliance Retail is a major player in India’s retail market, with a broad presence in fashion, electronics, groceries, and e-commerce through JioMart.

7. How is Reliance Industries addressing sustainability?

Reliance is investing in renewable energy projects, including solar and green hydrogen, and working to reduce its carbon footprint and improve sustainability across its operations.

8. How does Reliance manage its diversified business model?

Reliance operates through specialized divisions and leverages synergies across sectors, especially combining digital and retail services to enhance customer experience and streamline operations.

9. What are the challenges faced by Reliance Industries in the oil and gas sector?

Challenges include fluctuating oil prices, geopolitical instability, and environmental concerns, requiring continuous adaptation in its refining and petrochemical businesses.

10. What is the impact of Reliance Industries’ debt on its business?

Reliance’s significant debt poses financial risks, but its diversified business helps mitigate this. Efforts to reduce debt have improved its financial flexibility.