Tata Group is one of India’s largest and most respected conglomerates, with a diverse portfolio of companies operating in sectors such as steel, automobiles, information technology, consumer products, energy, and hospitality.

The group has a significant global footprint, with operations in more than 100 countries. Let’s elaborate the swot analysis of Tata Group in this article, Tata Group continues to build on its rich legacy while facing new opportunities and challenges in the global business environment.

Table of Contents

Overview of Tata Group

| Founder | Jamsetji Tata |

|---|---|

| Year Founded | 1868 |

| Origin | Mumbai, India |

| Industry | Conglomerate (Various sectors) |

| Annual Revenue | $128 billion (FY 2023-24) |

| Employees | 935,000+ |

| Global Presence | 100+ countries |

Tata Group’s companies include Tata Steel, Tata Motors, Tata Consultancy Services (TCS), Tata Power, Tata Consumer Products, and Tata Hotels (Taj), among others, making it a diverse and global powerhouse.

Current News on the Market on Tata Group

- Acquisitions and Expansions: Tata Group continues to expand through strategic acquisitions, including Tata Consumer Products’ increased focus on global markets and TCS’s expansion in North America and Europe.

- Sustainability Initiatives: The group has intensified its focus on sustainability, with Tata Steel leading the way toward carbon-neutral production by 2045, while Tata Motors pushes for electric vehicle (EV) leadership in India.

- Leadership Changes: Tata Sons announced a new CEO for Tata Motors, aimed at accelerating the company’s transition to EVs and optimizing operations.

- Digital Transformation: TCS continues to invest in AI and cloud-based technologies, bolstering its position as a global IT services leader, while Tata Digital focuses on enhancing the Tata Neu super app ecosystem.

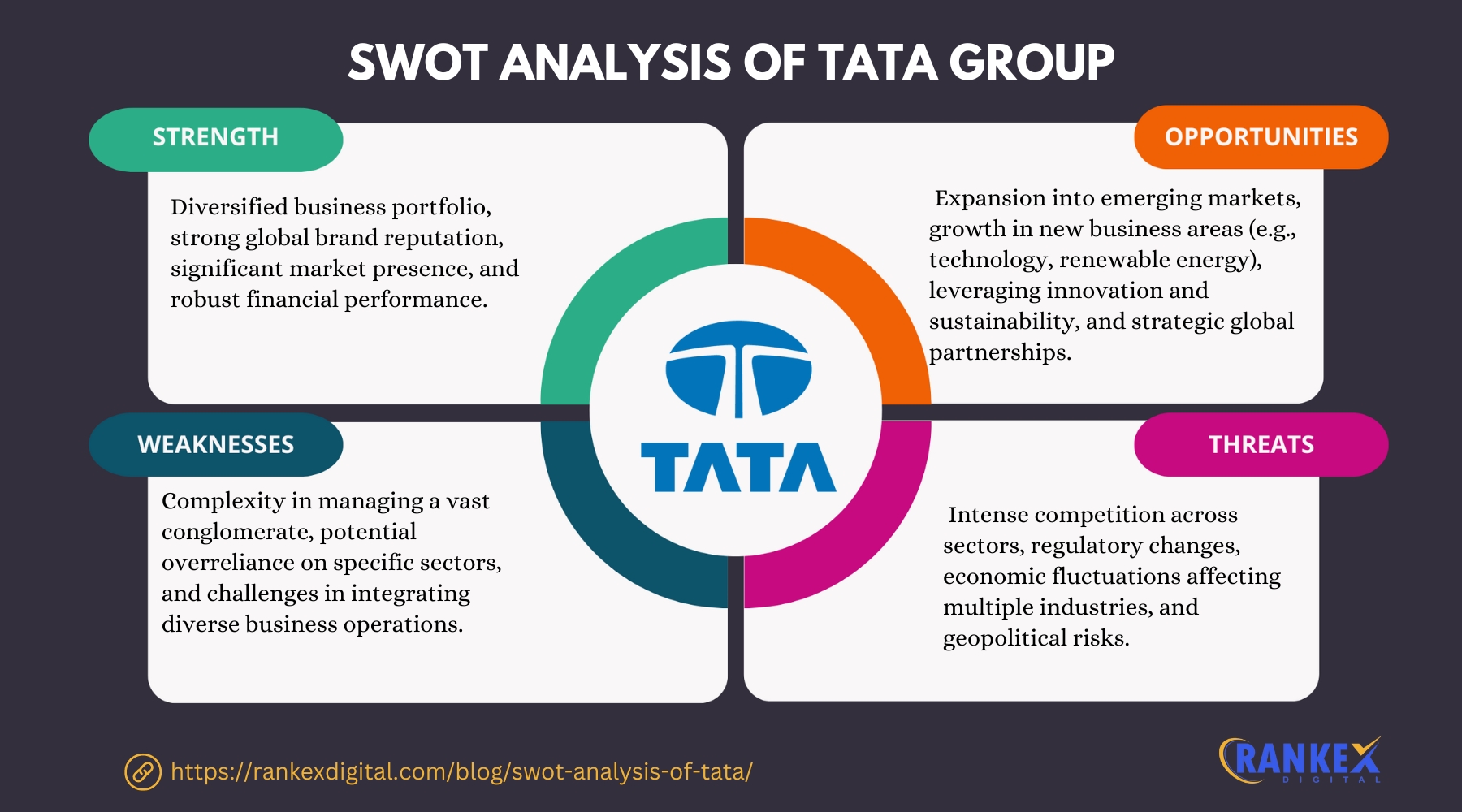

SWOT Analysis of Tata Group

Strengths of Tata Group

- Diversified Business Portfolio

Tata Group operates in a wide range of industries, from steel and automobiles to IT services and hospitality. This diversification reduces risk and ensures stability, even during downturns in specific sectors. - Strong Global Brand and Legacy

Tata Group enjoys a strong brand reputation both in India and globally. The Tata name is associated with trust, ethics, and reliability, which gives the group a competitive advantage across its various industries. - Leadership in Key Sectors

The group’s flagship companies—Tata Steel, Tata Motors, and TCS—are leaders in their respective industries. TCS is one of the largest IT services companies globally, and Tata Motors is a key player in the automobile sector, especially in electric vehicles. - Commitment to Sustainability

Tata Group is heavily invested in sustainable development. Tata Power is increasing its renewable energy capacity, while Tata Motors is leading the EV market in India. Tata Steel’s commitment to reducing carbon emissions by 2045 is another example of the group’s focus on sustainability. - Robust Financial Performance

Despite global economic challenges, Tata Group companies have consistently reported strong financial results. For instance, TCS remains highly profitable, contributing significantly to the group’s revenues.

Weaknesses of Tata Group

- Heavy Debt Load

Some of Tata Group’s businesses, particularly Tata Motors and Tata Steel, carry a substantial debt burden. Although these companies are taking steps to reduce debt, it remains a significant concern for the group. - Over-reliance on TCS for Profitability

A large portion of Tata Group’s profitability comes from TCS, its IT services division. This dependence on one company poses a risk, especially in the face of growing competition in the IT services industry and potential downturns in the tech sector. - Challenges in International Markets

Tata Steel’s European operations and Tata Motors’ international ventures (especially Jaguar Land Rover) have faced profitability issues due to high operational costs and market competition. This has hampered the group’s overall performance in global markets. - Regulatory and Environmental Challenges

The group’s industrial operations, particularly in sectors like steel and automobiles, face increasing regulatory pressure regarding environmental sustainability. Complying with stricter environmental regulations may lead to higher operational costs. - Leadership Transitions

Frequent leadership changes in key subsidiaries like Tata Motors and Tata Steel can lead to strategic disruptions and affect long-term planning and execution.

Opportunities for Tata Group

- Expansion in Emerging Markets

Tata Group has significant opportunities to expand its presence in emerging markets, particularly in Africa, Southeast Asia, and Latin America. These regions offer growing demand for infrastructure, automobiles, and consumer goods. - Electric Vehicle (EV) Revolution

Tata Motors is well-positioned to capitalize on the growing demand for electric vehicles in India and globally. With a robust pipeline of EV models and government incentives, Tata Motors can strengthen its position as a leader in the EV market. - Growth in IT Services and Digital Transformation

TCS continues to benefit from the global digital transformation wave. The increasing adoption of cloud computing, AI, and big data offers opportunities for TCS to expand its services in North America, Europe, and Asia. - Renewable Energy Expansion

Tata Power’s focus on increasing its renewable energy capacity presents a significant growth opportunity. The global shift toward clean energy offers new avenues for growth and aligns with the group’s sustainability goals. - Consumer Goods Expansion

Tata Consumer Products has been actively expanding its product portfolio, particularly in the health and wellness space. With growing consumer interest in health-oriented products, Tata Consumer Products can further diversify and strengthen its market position.

Threats to Tata Group

- Intense Competition

Tata Group faces stiff competition across multiple sectors. For example, Tata Motors competes with global giants like Tesla and traditional automakers in the EV market, while TCS faces increasing competition from other IT service providers like Infosys and Accenture. - Fluctuating Raw Material Prices

Tata Steel, Tata Motors, and other subsidiaries are highly vulnerable to fluctuations in raw material prices, such as steel, aluminum, and energy. Rising costs can erode profit margins and impact financial performance. - Economic Slowdowns

Any significant economic downturn, whether in India or globally, can affect demand for Tata Group’s products and services, particularly in sectors like automobiles, hospitality, and consumer goods. - Geopolitical Risks

Tata Group’s global operations expose it to geopolitical risks, including trade tensions, regulatory changes, and currency fluctuations. These factors can impact the group’s profitability and supply chain operations. - Regulatory and Environmental Compliance

Tata Group’s industrial businesses face increasing regulatory scrutiny, particularly around emissions and sustainability. Stricter regulations could increase costs, reduce operational flexibility, and affect the group’s ability to grow in certain markets.

Competitors of Tata Group

- Reliance Industries

Reliance is one of Tata Group’s primary competitors, especially in sectors like telecom (Jio vs. Tata Communications) and retail. Reliance has aggressively expanded its digital and retail businesses, posing a challenge to Tata’s consumer-facing ventures. - Mahindra & Mahindra

Mahindra competes with Tata Motors in the automotive sector, especially in electric vehicles, SUVs, and commercial vehicles. Mahindra is also expanding in the EV space, creating competition for Tata Motors. - Adani Group

Adani Group is a rising conglomerate in India, competing in sectors like power, infrastructure, and renewable energy. Adani’s rapid expansion poses a challenge to Tata Power and other Tata Group companies in these industries. - Infosys

Infosys is a direct competitor of TCS in the IT services sector. Both companies vie for leadership in global markets, providing services like digital transformation, cloud computing, and AI. - JSW Steel

JSW Steel competes directly with Tata Steel in the Indian and international steel markets. JSW has been aggressively expanding its capacity, posing a challenge to Tata Steel’s market leadership.

Conclusion

Tata Group remains one of the most diversified and respected conglomerates globally, with strengths such as a strong brand, diversified portfolio, and leadership in key sectors like IT and automobiles.

However, the group faces challenges such as high debt, reliance on certain key businesses, and increased competition.

By focusing on opportunities like the EV revolution, digital transformation, and renewable energy, Tata Group is well-positioned to maintain its leadership in the Indian and global markets.

Frequently Asked Questions

1. What are Tata Group’s main strengths?

Tata Group’s strengths include a diversified business portfolio, strong global brand recognition, leadership in sectors like IT and steel, and a commitment to sustainability.

2. What are Tata Group’s weaknesses?

Key weaknesses include a heavy debt burden in some subsidiaries, over-reliance on TCS for profitability, and operational challenges in global markets.

3. What opportunities lie ahead for Tata Group?

Opportunities include expanding in emerging markets, capitalizing on the EV revolution, growing its IT services business, and increasing its renewable energy capacity.

4. What threats does Tata Group face?

Threats include intense competition, fluctuating raw material prices, economic slowdowns, geopolitical risks, and stricter environmental regulations.