Tata Steel, a flagship company of the Tata Group, is one of the largest steel producers in the world. With a legacy spanning over a century, Tata Steel is known for its innovation, sustainability initiatives, and commitment to community development.

As of 2025, the swot analysis of Tata Steel relies on the company continues to play a significant role in the global steel industry while addressing challenges such as fluctuating raw material costs and environmental regulations.

Table of Contents

Overview of Tata Steel

| Founder | Jamsetji Tata |

|---|---|

| Year Founded | 1907 |

| Origin | India |

| Industry | Steel Manufacturing |

| Annual Revenue | $33 billion (FY 2023) |

| Employees | 80,500+ |

| Global Presence | 26+ countries |

Tata Steel has operations in countries like India, the UK, the Netherlands, and Thailand, and it serves a diverse range of industries including construction, automotive, and consumer goods.

Current News on the Market on Tata Steel

- Sustainability Focus: In 2023, Tata Steel committed to becoming carbon neutral by 2045, investing heavily in green steel production and renewable energy. The company has also pledged to use more recycled steel in its production processes.

- Global Expansion: Tata Steel has been expanding its operations in Europe and Southeast Asia, focusing on mergers and acquisitions to enhance its global footprint.

- Technological Advancements: Tata Steel is investing in digital transformation, using AI and machine learning to optimize production processes and improve efficiency.

- Performance in the Automotive Sector: Tata Steel remains a major supplier of high-grade steel to the global automotive industry, with increasing demand for lightweight steel in electric vehicles (EVs).

- Raw Material Challenges: Tata Steel faces challenges due to rising iron ore and coal prices, which are affecting the company’s profitability and increasing operational costs.

SWOT Analysis of Tata Steel

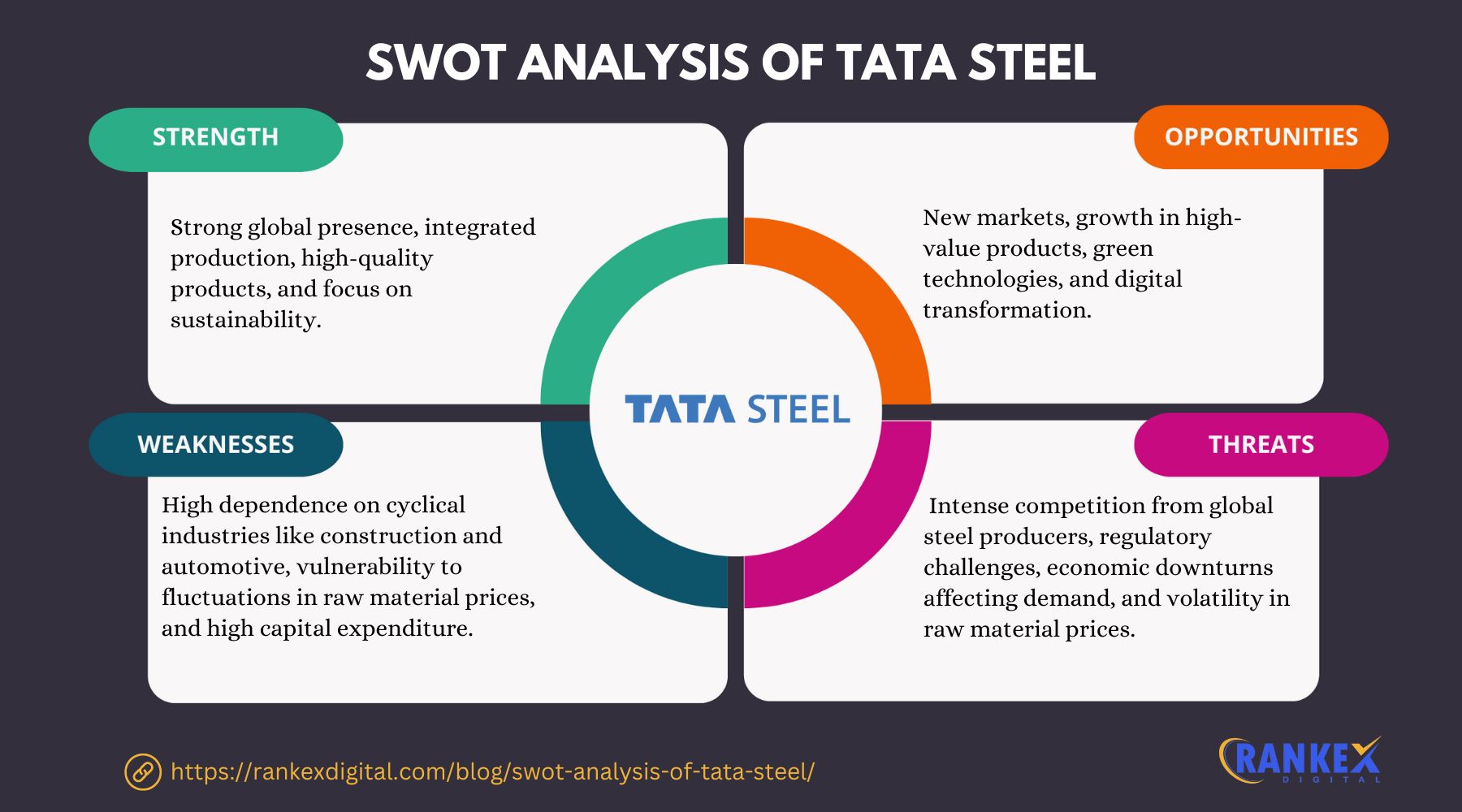

Strengths of Tata Steel

- Strong Global Presence

Tata Steel has a vast global presence, with operations in over 26 countries. This extensive network allows the company to cater to a wide array of industries, ensuring a diversified revenue stream and reducing dependence on any single market. - Vertical Integration

Tata Steel is a vertically integrated company, meaning it controls every stage of its production process, from mining raw materials to the manufacturing of finished products. This integration helps the company maintain quality control and cost efficiency. - Commitment to Sustainability

Tata Steel has made significant strides toward sustainability, with plans to reduce carbon emissions and adopt green technologies in steel production. The company’s efforts align with the global trend toward eco-friendly practices, strengthening its brand image. - Innovative Product Development

Tata Steel is known for its innovative approach to steel manufacturing. The company has introduced high-strength, lightweight steel for the automotive sector, catering to the growing demand for electric vehicles and fuel-efficient cars. - Strong Brand and Legacy

With over 100 years of experience, Tata Steel has built a strong reputation for quality and reliability. The Tata brand is one of the most trusted in India and internationally, which provides the company with a competitive edge.

Weaknesses of Tata Steel

- High Dependence on Raw Material Prices

Tata Steel’s profitability is highly sensitive to fluctuations in the prices of raw materials such as iron ore and coal. Any significant increase in these costs can negatively impact the company’s margins. - Environmental Concerns

Steel production is a carbon-intensive process, and despite Tata Steel’s commitment to sustainability, it faces regulatory pressure regarding emissions and environmental impact. This could lead to increased costs for adopting greener technologies. - Heavy Debt Load

Tata Steel has a significant debt burden, particularly due to its European operations. While the company has taken steps to reduce its debt, it remains a concern, especially in the face of economic downturns or rising interest rates. - Over-reliance on the Indian Market

A large portion of Tata Steel’s revenue comes from India, making the company somewhat vulnerable to fluctuations in the Indian economy. A slowdown in the domestic market could adversely affect the company’s performance. - Operational Challenges in Europe

Tata Steel’s European operations, particularly in the UK and the Netherlands, have faced challenges such as rising operational costs and increased competition. These challenges have hindered the profitability of its European business units.

Opportunities for Tata Steel

- Green Steel Production

With growing global demand for sustainable and environmentally friendly products, Tata Steel has the opportunity to lead in green steel production. By investing in carbon-neutral steel technologies, the company can position itself as a leader in this emerging market. - Expansion in Emerging Markets

Tata Steel has opportunities to expand further into emerging markets such as Southeast Asia and Africa. These regions are experiencing rapid urbanization and industrialization, driving demand for steel in infrastructure and construction projects. - Diversification of Product Offerings

By diversifying its product portfolio to include more high-tech and value-added steel products, such as those used in electric vehicles and renewable energy infrastructure, Tata Steel can increase its profitability and reduce reliance on commodity-grade steel. - Digital Transformation

Tata Steel has been investing in digital technologies such as AI, big data, and machine learning to optimize its operations and improve efficiency. Continued investment in these areas can help the company streamline its supply chain, reduce waste, and improve margins. - Strategic Acquisitions

Tata Steel can continue to pursue strategic acquisitions to expand its global footprint and access new markets. Acquiring companies with advanced technology and expertise in green steel production could further strengthen its competitive position.

Threats to Tata Steel

- Fluctuating Raw Material Prices

Tata Steel is vulnerable to price fluctuations in key raw materials, particularly iron ore and coal. Any significant increase in these costs can erode profit margins and affect the company’s overall financial performance. - Intense Global Competition

The global steel industry is highly competitive, with major players like ArcelorMittal, POSCO, and Nippon Steel posing a significant threat. Intense price competition can impact Tata Steel’s market share and profitability. - Environmental Regulations

The steel industry faces increasing pressure from governments and international bodies to reduce carbon emissions. Stricter regulations and environmental compliance could result in higher costs for Tata Steel, affecting its profitability. - Economic Slowdowns

Tata Steel’s performance is closely tied to economic growth, particularly in sectors like construction and automotive. Any slowdown in these industries, whether due to economic downturns or geopolitical tensions, could negatively impact demand for steel. - Technological Disruptions

The steel industry is witnessing technological advancements, including the development of new, lighter materials that could replace steel in certain applications. This could reduce demand for traditional steel products, posing a threat to Tata Steel’s core business.

Competitors of Tata Steel

- ArcelorMittal

ArcelorMittal is the world’s largest steel producer and a direct competitor to Tata Steel in the global market. The company has a strong presence in Europe and North America and competes with Tata Steel in the automotive and construction sectors. - POSCO

POSCO, based in South Korea, is another leading global steel producer. It competes with Tata Steel in the production of high-quality steel products for industries such as automotive, shipbuilding, and electronics. - Nippon Steel

Nippon Steel is a major player in the global steel industry, particularly in the Asia-Pacific region. It competes with Tata Steel in various sectors, including infrastructure and manufacturing. - JSW Steel

JSW Steel, another Indian steel giant, is one of Tata Steel’s biggest competitors in the Indian market. JSW has been aggressively expanding its capacity and market share, posing a significant challenge to Tata Steel in its domestic market. - Baowu Steel Group

Baowu Steel, a Chinese state-owned enterprise, is the second-largest steel producer globally. The company competes with Tata Steel on the international stage, particularly in emerging markets such as Africa and Southeast Asia.

Conclusion

Tata Steel continues to be a dominant player in the global steel industry, with strengths such as a strong brand, vertical integration, and a commitment to sustainability. However, the company faces challenges such as fluctuating raw material prices and environmental regulations. By focusing on opportunities like green steel production, digital transformation, and expansion in emerging markets, Tata Steel can strengthen its position in 2025 and beyond.

Frequently Asked Questions

1. What are the key strengths of Tata Steel?

Tata Steel’s key strengths include a strong global presence, vertical integration, innovative product development, a commitment to sustainability, and a strong brand reputation.

2. What are the weaknesses of Tata Steel?

Tata Steel’s weaknesses include high dependence on raw material prices, heavy debt, operational challenges in Europe, and environmental concerns.

3. What are the opportunities for Tata Steel in 2025?

Opportunities for Tata Steel include expansion into emerging markets, green steel production, digital transformation, product diversification, and strategic acquisitions.

4. What are the threats faced by Tata Steel?

Tata Steel faces threats from fluctuating raw material prices, intense competition, environmental regulations, economic slowdowns, and technological disruptions.