Walt Disney Company, a leader in the entertainment industry, has shaped global culture and created unforgettable experiences for audiences for decades. With its iconic films, theme parks, and media networks, Disney has become a powerhouse of imagination and creativity.

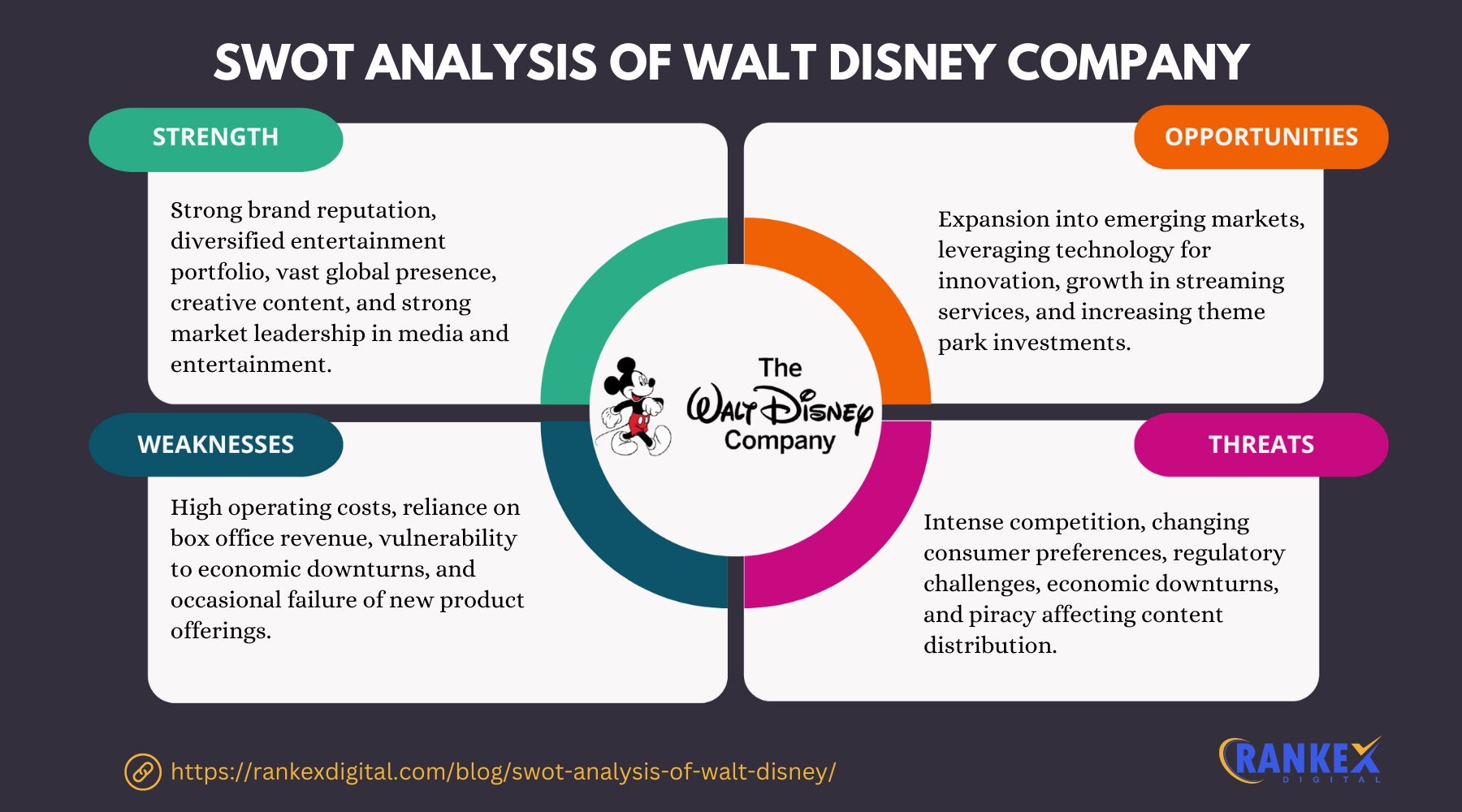

To evaluate its current market position and growth strategies, a SWOT analysis of Walt Disney Company is essential. This analysis sheds light on Disney’s strengths, weaknesses, opportunities, and threats, providing valuable insights into its future prospects.

Table of Contents

Overview of Walt Disney Company

Founded in 1923 by Walt Disney and Roy O. Disney, The Walt Disney Company is one of the world’s largest and most diversified entertainment conglomerates. Headquartered in Burbank, California, Disney operates through various segments, including Media Networks, Parks, Experiences & Products, Studio Entertainment, and Direct-to-Consumer & International.

With a global presence, Disney continues to expand its reach and influence, maintaining a legacy of creativity and innovation.

Quick Stats About Walt Disney Company

| Attribute | Details |

|---|---|

| Founder | Walt Disney, Roy O. Disney |

| Year Founded | 1923 |

| Origin | Burbank, California, USA |

| Number of Employees | 223,000+ |

| CEO | Bob Iger |

| Company Type | Public |

| Market Cap | $188 Billion |

| Annual Revenue | $87 Billion |

| Net Profit | $3.5 Billion |

Current News of Walt Disney Company

- Streaming Focus: Disney has made significant investments in its streaming services, including Disney+, ESPN+, and Hulu, to compete in the growing digital entertainment market.

- Theme Park Innovations: Disney continues to innovate and expand its theme parks, introducing immersive experiences like Star Wars: Galaxy’s Edge and Marvel-themed attractions.

- Content Expansion: With a growing catalog of beloved franchises such as Marvel, Pixar, and Star Wars, Disney continues to produce high-quality, engaging content across multiple platforms.

- Leadership Transition: The company has gone through leadership changes with Bob Iger returning as CEO, shifting focus back to creativity and content-driven growth.

SWOT Analysis of Walt Disney Company

Strengths:

- Iconic Brand Portfolio: Disney owns and operates some of the most recognizable and valuable brands in the world, such as Marvel, Pixar, Lucasfilm, and the legacy Walt Disney brand itself. These brands hold immense cultural significance and have a large, dedicated fan base, making Disney a dominant force in entertainment across multiple sectors—movies, television, merchandise, theme parks, and beyond.

- Global Market Reach: Disney’s products and services have a vast global presence, allowing the company to tap into different markets across continents. Disney has expanded its reach through its theme parks, TV networks, movies, merchandise, and digital streaming services. With such widespread recognition, Disney enjoys a strong foothold in more than 40 countries, making it a key player in the global entertainment industry.

- Strong Digital and Streaming Platforms: Disney’s streaming service, Disney+, has quickly become a formidable competitor in the streaming wars, largely due to its extensive library of beloved films, shows, and original content (like The Mandalorian and the Marvel Cinematic Universe series). Disney’s strategy has been successful in attracting millions of subscribers worldwide, positioning itself as a viable alternative to Netflix, Amazon Prime Video, and other streaming services.

- Diversified Revenue Streams: Disney operates in various sectors, including film production, theme parks, media networks, and consumer products (merchandising and licensing). This diversification allows the company to reduce risk and maintain steady revenue streams. While one segment may experience a downturn (e.g., film box office), other sectors like theme parks or merchandise can provide a buffer.

- Innovation and Creativity: Disney has built a legacy of creative excellence. Its innovations in animation (e.g., Snow White, Pixar’s CGI technology), theme park design (e.g., immersive experiences like Galaxy’s Edge), and storytelling are industry benchmarks. Disney constantly pushes boundaries in creativity, setting trends rather than following them, which strengthens its brand and drives consumer interest.

Weaknesses:

- Heavy Dependence on Theme Parks: Disney’s theme parks are a major source of revenue, but they are highly susceptible to external factors, such as economic fluctuations, geopolitical instability, and global pandemics (like COVID-19). For instance, during the pandemic, Disney had to close many of its parks, leading to significant financial losses. The parks’ performance can also vary due to changing consumer preferences or natural disasters.

- High Operational Costs: Running Disney’s theme parks and entertainment businesses comes with significant costs. These include the cost of maintaining theme park attractions, staffing large-scale productions, and managing a global media empire. These expenses can limit profitability, especially when consumer demand drops or if external factors disrupt operations.

- Content Saturation: Disney has relied heavily on its existing franchises (e.g., Star Wars, Marvel, and Pixar) for new content creation. While these franchises are highly successful, this over-reliance may result in audience fatigue. Fans could lose interest in repetitive or formulaic content, and the company may face challenges in creating original narratives that appeal to a wide audience.

- Public Perception of Corporate Decisions: Disney has faced public scrutiny over several controversial business decisions, such as conflicts with creative talent, employee strikes, or handling of sensitive cultural issues in its films. These controversies can negatively impact the company’s public image and the loyalty of its audience.

- Competition in Streaming: Disney+ has carved out a niche for itself in the streaming market, but it faces intense competition from established players like Netflix, and Amazon Prime, and newer entrants like Apple TV+. These competitors have vast content libraries and significant financial resources, making it challenging for Disney to maintain its subscriber base and expand its presence in the highly competitive streaming landscape.

Opportunities:

- Expanding Streaming Services: The increasing demand for digital content presents a growth opportunity for Disney+. The company can continue to enhance its streaming service by offering exclusive content, such as new series, films, and documentaries, to attract and retain subscribers. Disney can also expand its service into new global markets to further capture the growing demand for streaming content.

- Global Theme Park Expansion: Disney has the opportunity to expand its theme park operations in emerging markets, particularly in Asia. Countries like China and India are seeing growing middle-class populations with an increasing appetite for leisure and entertainment. Disney could tap into these markets by expanding its parks and creating tailored experiences that align with local cultures and tastes.

- Leveraging Technology: Disney has the potential to invest in emerging technologies like virtual reality (VR) and augmented reality (AR) to further enhance its offerings. For example, VR can be integrated into theme park rides or immersive experiences, while AR could be used in apps or games to bring Disney characters and stories to life in new, interactive ways. The gaming sector, in particular, could benefit from more advanced technological integration.

- Merchandising and Licensing: Disney’s extensive portfolio of intellectual properties (IPs) allows the company to generate substantial revenue from merchandising and licensing. From toys and clothing to home goods and themed experiences, Disney has countless opportunities to expand its revenue through collaborations with third-party brands, special editions, and global licensing agreements.

- Strategic Acquisitions: Disney can further strengthen its position by making strategic acquisitions in areas like gaming, online content platforms, and international content. For example, acquiring companies in emerging tech sectors, content providers, or digital platforms could help Disney expand its reach and diversify its revenue streams.

Threats:

- Intense Competition in Entertainment: The entertainment industry is highly competitive, with global players like Netflix, Amazon Prime Video, and Warner Bros. challenging Disney across various segments. These competitors also create their own content, which can dilute Disney’s market share. The rise of independent creators and new media platforms further increases the competition.

- Changing Consumer Preferences: As consumer preferences evolve, particularly with younger generations who prefer on-demand content or interactive experiences, Disney faces the challenge of staying relevant. Traditional forms of entertainment, such as linear TV or large-scale movies, may lose appeal, and Disney needs to adapt to meet the needs of these changing tastes.

- Economic Downturns: Economic recessions or downturns can significantly impact Disney’s revenue streams, especially in its theme parks and consumer products segments. During such times, people are less likely to travel, spend money on vacations, or purchase non-essential items. This can directly affect Disney’s bottom line, especially when many of its core businesses are based on discretionary spending.

- Regulatory Challenges: Changes in media regulations, copyright laws, or trade regulations—especially in international markets—could pose a threat to Disney’s operations. For example, new copyright laws or increased tariffs in foreign countries could impact Disney’s ability to distribute content or merchandise globally. Changing regulations around data privacy could also impact Disney’s digital businesses and streaming services.

- Crisis in Reputation: Any missteps by Disney in dealing with sensitive issues (such as diversity and inclusion, or backlash against its handling of specific content) could damage its reputation and alienate customers. Negative public perception could hurt Disney’s brand image, and with the rise of social media, reputational crises can quickly spread and affect consumer loyalty.

Top Competitors of the Walt Disney Company

- Netflix

- Comcast (NBCUniversal)

- Warner Bros. Discovery

- Sony Pictures

- Amazon Studios

Conclusion

The SWOT analysis of The Walt Disney Company reveals a blend of powerful strengths, such as its strong brand portfolio, global reach, and innovative digital strategies. However, challenges persist, particularly in areas like operational costs, reliance on theme parks, and competition in the streaming market.

By focusing on expansion in streaming services, leveraging emerging technologies, and capitalizing on global growth opportunities, Disney can continue to stay ahead in the entertainment industry. Nevertheless, the company must carefully manage its weaknesses and respond to external threats to maintain its leadership position.

Frequently Asked Questions

What is the main source of revenue for Walt Disney Company?

Disney’s main sources of revenue come from its media networks (e.g., ABC, ESPN), theme parks, studio entertainment (films), and streaming services (Disney+).

How does Disney+ compare to other streaming platforms?

Disney+ offers exclusive content from Disney’s massive portfolio of brands, including Marvel, Pixar, Star Wars, and National Geographic. It competes with other streaming services like Netflix and Amazon Prime with its family-friendly and franchise-based content.

What are some of the biggest challenges Disney faces?

Disney faces challenges such as intense competition in the entertainment sector, rising operational costs, changes in consumer preferences, and vulnerability to economic downturns.

How does Disney maintain its competitive edge in the market?

Disney maintains its competitive edge through innovation, a diversified content portfolio, global brand recognition, and strategic investments in technology and digital platforms.

What are the future growth opportunities for the Walt Disney Company?

Disney’s growth opportunities include expanding its streaming services, increasing international market penetration, and leveraging emerging technologies such as VR and AR in theme parks and entertainment.