Indian Oil Corporation Limited (IOCL) is India’s largest oil refining and marketing company and one of the leading players in the global energy sector.

With a diverse portfolio that spans refining, pipeline transportation, marketing of petroleum products, and exploration, IOCL plays a critical role in India’s energy security.

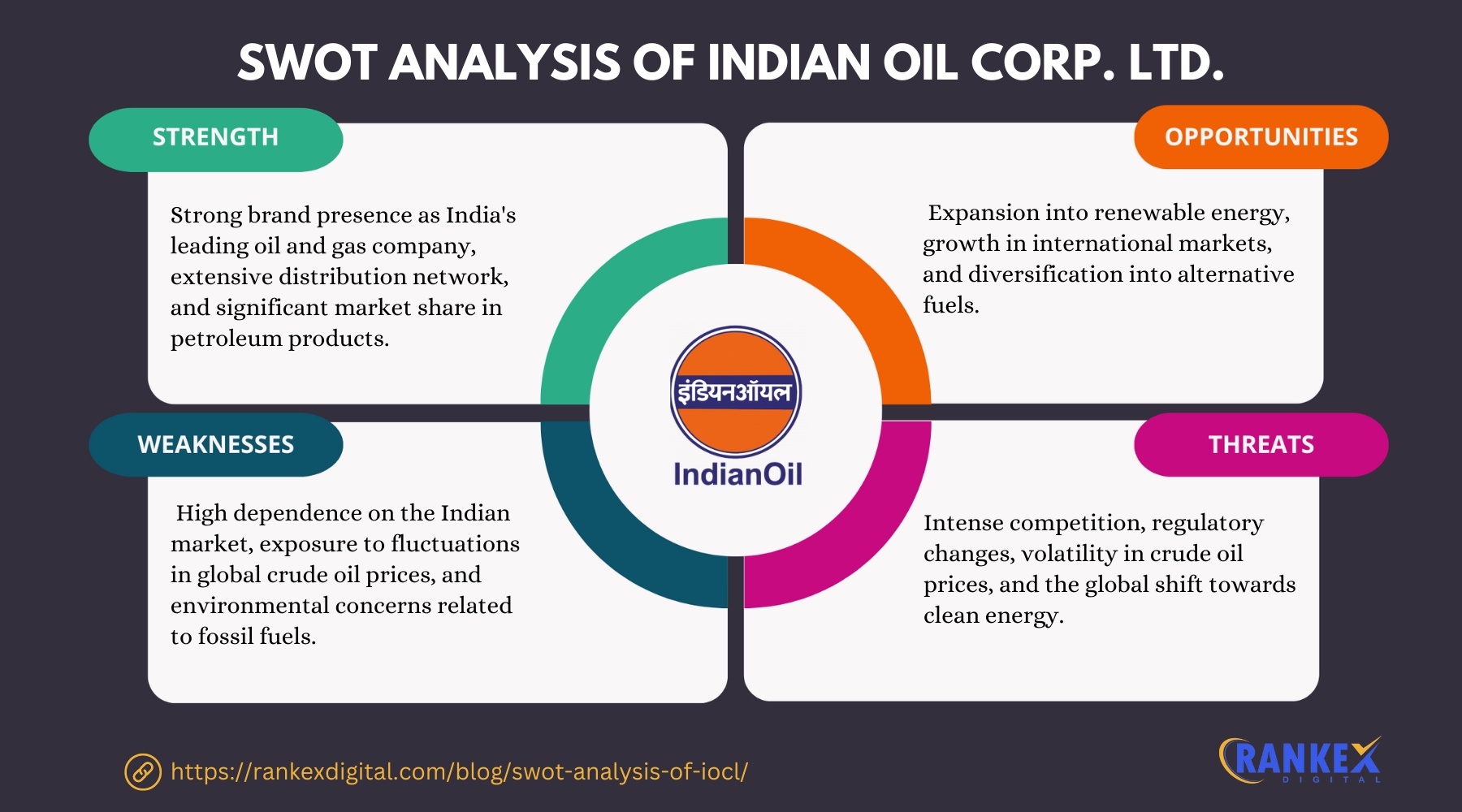

This SWOT analysis of IOCL in 2025 delves into the company’s strengths, weaknesses, opportunities, and threats in a rapidly evolving energy landscape.

In this blog

Overview of IOCL

| Founder | Government of India |

|---|---|

| Year Founded | 1959 |

| Headquarters | New Delhi, India |

| Industry | Energy, Oil & Gas |

| Annual Revenue | $101.5 billion (FY 2023) |

| No. of Employees | 33,000+ |

| Key Markets | India, Southeast Asia, Middle East |

Current News on the Market on IOCL

- Investment in Green Energy: IOCL is accelerating its investments in green energy projects, particularly in renewable energy sources like solar and hydrogen. The company has announced plans to set up hydrogen production units and expand its solar energy capacity in line with India’s commitment to reducing carbon emissions.

- Partnerships for Expansion: IOCL has signed agreements with global companies to enhance its refining and petrochemical capacities. The company is collaborating with international energy firms to strengthen its position in the global energy market.

- Increased Focus on Biofuels: As part of India’s green energy transition, IOCL is pushing for biofuels adoption. The company is setting up ethanol production units and blending biofuels with conventional fuels to support government initiatives for reducing fossil fuel dependence.

SWOT Analysis of IOCL

Strengths of IOCL

- Market Leadership in India

IOCL is the largest oil refining and marketing company in India, with a massive market share in the domestic energy sector. The company’s strong brand equity and extensive network of refineries, pipelines, and retail outlets make it a dominant force in the Indian market. - Integrated Business Model

IOCL operates across the entire energy value chain, from refining and exploration to transportation, marketing, and retail. This integrated approach allows the company to optimize operations, reduce costs, and improve profitability. - Robust Distribution Network

IOCL has an extensive distribution network with over 32,000 fuel stations across India, making it easily accessible to consumers. This strong retail presence gives IOCL a competitive edge over its rivals in fuel marketing. - Government Support

Being a state-owned enterprise, IOCL benefits from strong government support in terms of policies, subsidies, and strategic guidance. This support has enabled the company to maintain a steady growth trajectory and safeguard against market volatility. - Commitment to R&D

IOCL invests heavily in research and development (R&D), particularly in cleaner fuels, refining technology, and alternative energy sources. Its R&D efforts enable the company to innovate and stay ahead in a highly competitive market.

Weaknesses of IOCL

- Dependence on Fossil Fuels

A significant portion of IOCL’s revenue comes from the sale of petroleum products, which are subject to fluctuating global crude oil prices. As the world shifts toward renewable energy, IOCL’s dependence on fossil fuels could become a long-term challenge. - Environmental Concerns

Despite efforts to diversify into cleaner energy sources, IOCL still faces criticism for its role in contributing to pollution and carbon emissions. Public perception of fossil fuel companies as major polluters can affect the company’s reputation and investor interest. - Limited International Presence

While IOCL is a leader in the Indian market, its global footprint remains limited compared to other multinational oil companies like ExxonMobil or Royal Dutch Shell. Expanding its presence in international markets has been slow, limiting growth potential outside India. - Vulnerability to Price Controls

As a government-owned entity, IOCL is often subject to price controls on petroleum products. These controls can limit the company’s ability to adjust fuel prices in response to global crude oil price fluctuations, affecting its profitability. - High Operational Costs

IOCL’s large and complex operations result in high fixed and variable costs. The company’s refining and distribution infrastructure requires significant investment and maintenance, leading to potential profitability challenges during periods of low demand.

Opportunities for IOCL

- Expansion into Renewable Energy

With the global shift toward sustainable energy, IOCL has the opportunity to expand its renewable energy portfolio. The company is already investing in solar energy, hydrogen, and biofuels, and can leverage its infrastructure to accelerate this transition. - Growth in Natural Gas

The demand for natural gas as a cleaner alternative to coal and oil is increasing. IOCL can expand its presence in the natural gas sector by developing more LNG terminals, pipelines, and retail outlets for compressed natural gas (CNG). - Biofuel Development

IOCL’s focus on biofuels offers a growth opportunity. The company is working on developing and blending biofuels, such as ethanol and biodiesel, with conventional fuels. This aligns with India’s goal of reducing dependence on imported oil and lowering carbon emissions. - Partnerships and Joint Ventures

IOCL can strengthen its international presence by entering into strategic partnerships and joint ventures with global energy companies. These collaborations can help IOCL access new markets, technologies, and expertise. - Digital Transformation

With the rise of digitalization, IOCL can explore new avenues for enhancing its operations and customer engagement. From improving supply chain management to introducing digital platforms for fuel distribution, digital transformation can boost efficiency and customer satisfaction.

Threats to IOCL

- Volatility in Global Oil Prices

As a major player in the oil industry, IOCL is highly exposed to fluctuations in global crude oil prices. Price volatility can impact its margins, especially if price controls in India prevent the company from passing on higher costs to consumers. - Regulatory and Environmental Pressures

Increasing environmental regulations and stricter emission norms pose a significant threat to IOCL’s operations. The company will need to invest in cleaner technologies and adapt to new regulations to remain compliant, which could increase operational costs. - Competition from Private and Global Players

IOCL faces intense competition from private sector companies like Reliance Industries and global giants such as BP and Chevron. Private firms often have more flexibility in pricing and strategy, which can put pressure on IOCL’s market share. - Shift Toward Electric Vehicles (EVs)

The growing adoption of electric vehicles (EVs) presents a long-term threat to IOCL’s core business of fuel retailing. As consumers shift from gasoline and diesel vehicles to EVs, demand for petroleum products could decline, impacting the company’s profitability. - Geopolitical Risks

As an importer of crude oil, IOCL is vulnerable to geopolitical instability in major oil-producing regions. Disruptions in the global oil supply chain due to conflicts or sanctions can lead to supply shortages and higher prices.

Competitors of IOCL

- Reliance Industries

Reliance Industries is a major competitor, particularly in the refining and petrochemical sectors. Its aggressive expansion into the retail fuel market with Reliance BP Mobility poses a direct challenge to IOCL’s dominance in fuel retailing. - Bharat Petroleum Corporation Limited (BPCL)

BPCL is another major state-owned competitor in the Indian oil and gas industry. The company operates across refining, marketing, and distribution, making it one of IOCL’s top competitors. - Hindustan Petroleum Corporation Limited (HPCL)

HPCL is a key competitor in India’s petroleum industry. With a strong refining and distribution network, HPCL competes with IOCL in the fuel retail and LPG segments. - ONGC

Oil and Natural Gas Corporation (ONGC) competes with IOCL in the exploration and production of hydrocarbons. Although ONGC focuses more on upstream activities, it remains a critical player in India’s oil and gas ecosystem. - Shell

Shell is a global competitor with a presence in India’s fuel retailing sector. As Shell expands its network of fuel stations and invests in renewable energy, it poses a significant threat to IOCL’s market share.

Wrapping it Up

Indian Oil Corporation Ltd. (IOCL) is a dominant force in India’s oil and gas industry, with an extensive distribution network and strong government backing.

As the energy sector shifts toward sustainability, IOCL is focusing on diversifying into renewable energy, natural gas, and biofuels to align with global trends.

However, the company must navigate challenges such as price volatility, regulatory pressures, and the growing shift toward electric vehicles.

By leveraging its strengths and capitalizing on new opportunities in green energy, IOCL can continue to play a pivotal role in India’s energy future.

Frequently Asked Questions

1. What are IOCL’s strengths?

IOCL’s strengths include its market leadership in India, integrated business model, robust distribution network, government support, and commitment to R&D.

2. What challenges does IOCL face in 2025?

IOCL faces challenges such as dependence on fossil fuels, environmental concerns, limited international presence, vulnerability to price controls, and high operational costs.

3. What are the opportunities for IOCL in the coming years?

Key opportunities for IOCL include expanding into renewable energy, growing its natural gas business, biofuel development, forming partnerships, and undergoing digital transformation.

4. Who are the major competitors of IOCL?

IOCL’s major competitors include Reliance Industries, BPCL, HPCL, ONGC, and Shell.

5. How is IOCL addressing environmental concerns?

IOCL is investing in renewable energy sources like solar and hydrogen, as well as focusing on biofuels to reduce its carbon footprint and align with India’s sustainability goals.