IDBI Bank, also known as the Industrial Development Bank of India, is one of the largest public sector banks in India.

Established in 1964 to provide credit and other financial facilities for the development of Indian industry, IDBI Bank has since evolved into a full-service commercial bank.

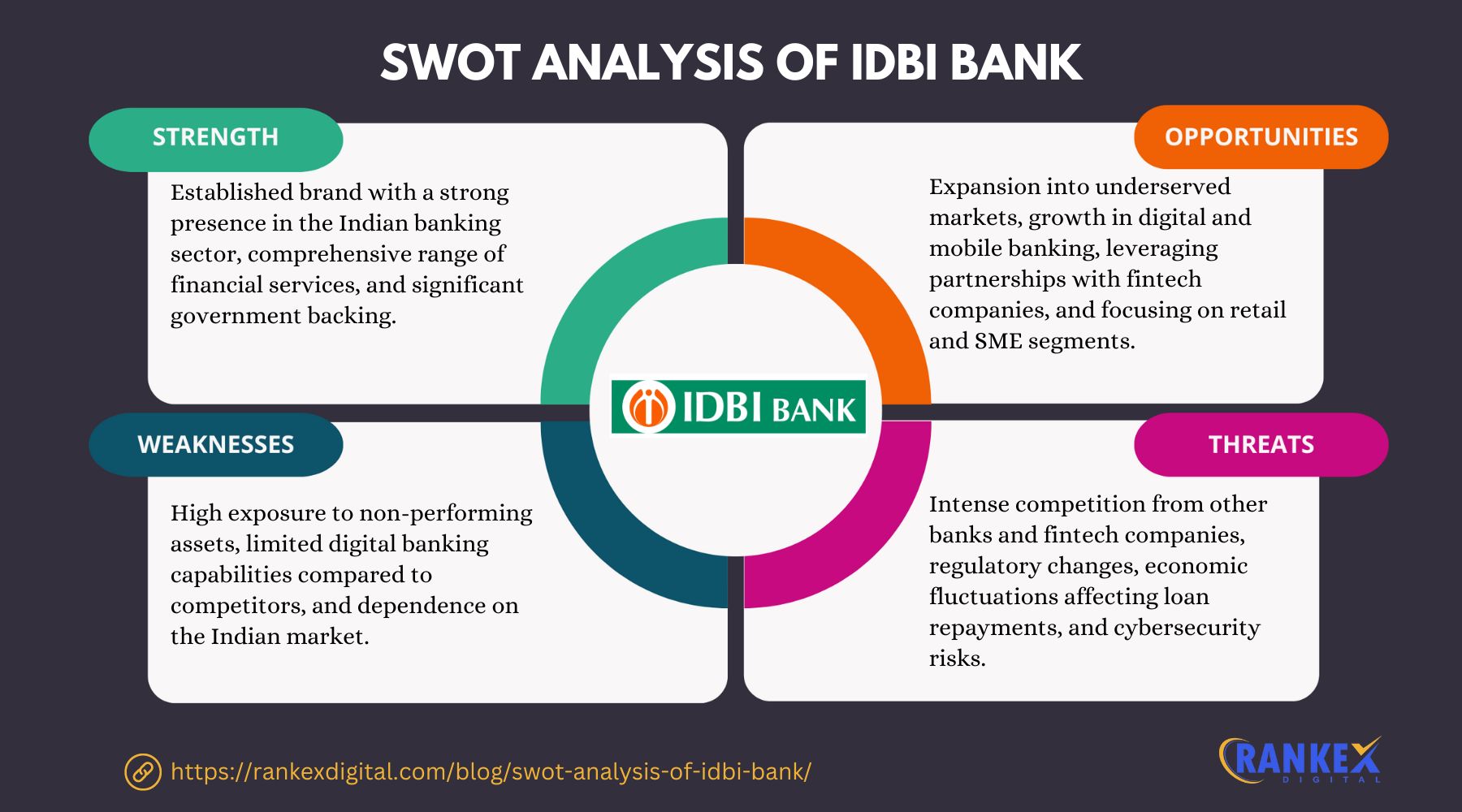

Conducting a SWOT analysis of IDBI Bank’s current market position and future potential. This article delves into IDBI Bank’s strengths, weaknesses, opportunities, and threats, providing a comprehensive view of the bank’s strategic landscape.

In this blog

Overview of IDBI Bank

IDBI Bank is headquartered in Mumbai, Maharashtra, India. It offers a wide range of financial products and services, including retail banking, corporate banking, and treasury operations.

With a robust network of branches and ATMs across the country, IDBI Bank serves millions of customers. Known for its focus on industrial financing and development, the bank has played a crucial role in the economic growth of India.

Quick Stats About IDBI Bank

| Founder | Government of India |

| Year Founded | 1964 |

| Origin | Mumbai, Maharashtra, India |

| No. of Employees | 17,000+ |

| CEO | Rakesh Sharma |

| Company Type | Public |

| Market Cap | $6 Billion |

| Annual Revenue | $3 Billion |

| Net Profit | $0.2 Billion |

SWOT Analysis of IDBI Bank

Strengths of IDBI Bank

IDBI Bank possesses several strengths that have contributed to its position in the banking industry:

- Established Brand: IDBI Bank is a well-recognized brand in India, known for its long history and association with industrial development.

- Government Support: Being a public sector bank, IDBI enjoys significant support from the government, which can be beneficial in times of financial stress.

- Extensive Network: The bank has a widespread network of branches and ATMs, ensuring accessibility and convenience for customers across India.

- Diverse Product Portfolio: IDBI Bank offers a comprehensive range of financial products and services, catering to both retail and corporate customers.

- Strong Asset Base: The bank has a substantial asset base, providing a solid foundation for its lending and investment activities.

- Experience in Project Financing: IDBI Bank has extensive experience in project financing, particularly in the industrial sector, making it a preferred bank for large-scale projects.

Weaknesses of IDBI Bank

Despite its strengths, IDBI Bank faces certain weaknesses that can hinder its growth and performance:

- High Non-Performing Assets (NPAs): One of the significant challenges for IDBI Bank is its high level of NPAs, which affects profitability and financial stability.

- Operational Inefficiencies: The bank faces issues related to operational inefficiencies, leading to higher costs and reduced profitability.

- Limited Technological Advancements: Compared to private sector banks, IDBI Bank lags in adopting new technologies and digital banking solutions.

- Dependence on Government Policies: As a public sector bank, IDBI is highly dependent on government policies and directives, which can sometimes limit its operational flexibility.

- Weak Financial Performance: In recent years, IDBI Bank has faced challenges in maintaining strong financial performance, with declining profitability and return on assets.

Opportunities for IDBI Bank

IDBI Bank can explore several opportunities to enhance its growth and market position:

- Digital Banking Expansion: With the growing demand for digital banking services, IDBI Bank can invest in advanced technologies to enhance its digital offerings and attract tech-savvy customers.

- Diversification of Services: The bank can introduce new financial products and services, such as insurance, wealth management, and fintech solutions, to diversify its revenue streams.

- Focus on SME Sector: By focusing on the small and medium-sized enterprises (SME) sector, IDBI Bank can tap into a growing market segment and enhance its loan portfolio.

- Strategic Partnerships: Forming strategic alliances with fintech companies and other financial institutions can enhance IDBI Bank’s service offerings, innovation capabilities, and market reach.

- Financial Inclusion Initiatives: Leveraging government initiatives aimed at financial inclusion, IDBI Bank can expand its customer base in rural and underserved areas.

Threats to IDBI Bank

IDBI Bank faces several threats that can impact its business and market position:

- Intense Competition: The banking sector in India is highly competitive, with numerous private and public sector banks vying for market share, posing a threat to IDBI Bank’s customer base and profitability.

- Regulatory Changes: Changes in banking regulations, monetary policies, and compliance requirements can impact IDBI Bank’s operations, profitability, and strategic initiatives.

- Economic Fluctuations: Economic downturns, fluctuations, and market volatility can affect the bank’s performance, particularly in terms of loan defaults, credit risk, and investment returns.

- Technological Disruptions: The rapid pace of technological advancements in the banking sector poses a threat to IDBI Bank, which may struggle to keep up with the latest innovations and customer expectations.

- Cybersecurity Risks: As banks increasingly adopt digital platforms, the risk of cyberattacks and data breaches becomes a significant threat, potentially harming IDBI Bank’s reputation and financial stability.

Conclusion

The SWOT analysis of IDBI Bank highlights its established brand, government support, extensive network, diverse product portfolio, strong asset base, and experience in project financing as key strengths.

However, high non-performing assets, operational inefficiencies, limited technological advancements, dependence on government policies, and weak financial performance are notable weaknesses.

Opportunities for IDBI Bank lie in expanding digital banking services, diversifying its service offerings, focusing on the SME sector, forming strategic partnerships, and leveraging financial inclusion initiatives. Threats include intense competition, regulatory changes, economic fluctuations, technological disruptions, and cybersecurity risks.

By leveraging its strengths and opportunities and addressing its weaknesses and threats, IDBI Bank can continue to grow and maintain its position in the banking sector.

Frequently Asked Questions

1. What is IDBI Bank?

IDBI Bank is one of India’s largest public sector banks, offering a wide range of financial products and services, including retail banking, corporate banking, and treasury operations.

2. When was IDBI Bank founded?

IDBI Bank was founded in 1964.

3. What services does IDBI Bank offer?

IDBI Bank offers a variety of services, including savings and current accounts, loans, credit cards, investment products, and digital banking services.

4. How does IDBI Bank maintain its competitive edge?

IDBI Bank maintains its competitive edge through its established brand, government support, extensive network, diverse product portfolio, and experience in project financing.

5. What are the main challenges faced by IDBI Bank?

The main challenges faced by IDBI Bank include high non-performing assets, operational inefficiencies, limited technological advancements, dependence on government policies, and weak financial performance.

6. How can IDBI Bank improve its profitability?

IDBI Bank can improve its profitability by optimizing operational efficiency, investing in digital banking technologies, diversifying its product portfolio, and focusing on the SME sector.

7. Who are IDBI Bank’s top competitors?

IDBI Bank’s top competitors are SBI Bank, HDFC Bank, Axis Bank, Punjab National Bank, Kotak Mahindra Bank, and ICICI Bank.