Byju’s has grown into one of the world’s most recognized EdTech companies. It’s innovative app and online courses focus on personalized learning.

The company has scaled globally, offering educational content across different subjects and age groups.

However, as it navigates the challenges and opportunities, Byju faces increased competition and regulatory scrutiny.

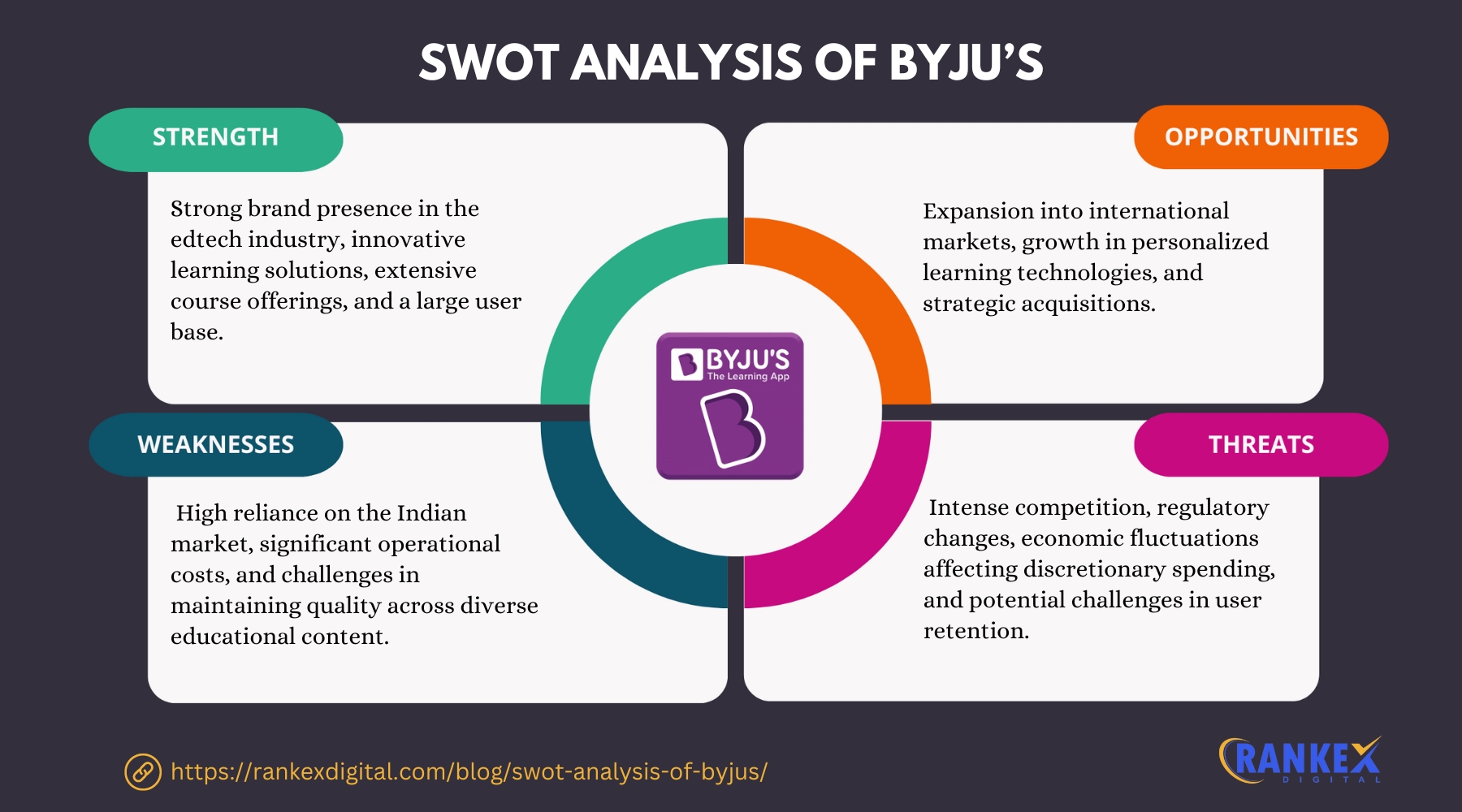

Here’s a detailed SWOT analysis of Byju’s with its strengths, weaknesses, opportunities, and threats.

In this blog

Overview of Byju’s

| Founder | Byju Raveendran |

|---|---|

| Year Founded | 2011 |

| Origin | Bengaluru, India |

| Industry | Education Technology (EdTech) |

| Annual Revenue | $1.4 Billion (FY 2023) |

| No. of Employees | 50,000+ |

| Key Markets | India, USA, Middle East, and Southeast Asia |

Current News on the Market on Byju’s

- Debt Restructuring and Funding Woes: Recently, Byju’s is grappling with restructuring its debt while trying to raise new funding. The EdTech giant has faced challenges in securing new investments, as several prominent investors have either reduced their exposure or pulled out completely.

- Expansion into International Markets: Byju’s has been making strides to expand into new regions like the Middle East and Southeast Asia. Its acquisition of Epic! and Osmo has helped to strengthen its footprint in the U.S. and global K-12 markets.

- Increased Regulatory Scrutiny: Due to increasing concerns over misleading advertising and sales practices, Byju’s has come under regulatory scrutiny in India, particularly regarding transparency in student success rates and course fees.

SWOT Analysis of Byju’s

Strengths of Byju’s

- Strong Brand Recognition

Byju’s has established itself as one of the most recognizable EdTech brands globally. Its large-scale marketing campaigns and endorsements by well-known figures, including celebrities, have made it a household name in India and beyond. - Comprehensive Digital Learning Platform

Byju’s offers a wide variety of learning solutions, catering to students from kindergarten to higher education. The platform covers several subjects, competitive exams, and professional courses, providing students with a comprehensive learning environment. - Innovative and Engaging Learning Tools

The use of interactive videos, gamification, and AI-based personalized learning has made Byju’s a pioneer in the digital learning space. The platform offers engaging and user-friendly content that keeps students motivated. - Global Expansion through Acquisitions

Byju’s strategic acquisitions, such as WhiteHat Jr, Epic!, and Osmo, have significantly enhanced its offerings and expanded its global footprint. These acquisitions have allowed Byju’s to tap into international markets, particularly in the U.S., Europe, and the Middle East. - Scalable Business Model

Byju’s operates on a scalable business model with a subscription-based structure. It also generates revenue through partnerships, school collaborations, and competitive exam preparation, ensuring diversified income streams.

Weaknesses of Byju’s

- High Dependence on India

Although Byju’s has expanded globally, a large portion of its revenue still comes from India. This over-dependence on the Indian market makes it vulnerable to local economic fluctuations, regulatory changes, and market saturation. - Rising Operational Costs

Byju’s aggressive expansion and acquisitions have significantly increased its operational costs, leading to financial strain. The company has had to restructure its debt and faces challenges in maintaining profitability, which could affect its future growth. - Criticism Over Sales Practices

Byju’s has been criticized for its aggressive sales tactics, particularly in India. The company has faced backlash from parents and students who feel pressured into purchasing expensive courses and subscriptions. This has led to negative media coverage and regulatory scrutiny. - Debt and Financial Strain

The company’s financial woes have been highly publicized. Byju’s has struggled with debt restructuring and investor confidence, leading to a drop in its valuation and financial challenges in raising fresh capital. - Leadership Instability

Internal leadership changes and departures have caused some instability within the company, leading to a perceived lack of direction. This is particularly concerning as Byju’s aims to navigate its debt restructuring and growth plans.

Opportunities for Byju’s

- Growth in International Markets

Byju’s expansion into the U.S., Middle East, and Southeast Asia offers immense growth potential. The demand for online learning platforms is on the rise, particularly in regions with underdeveloped traditional education systems, providing Byju’s with untapped market opportunities. - Introduction of Skill-Based Learning

The growing need for skill-based and vocational education presents an opportunity for Byju’s to diversify its offerings. Partnering with institutions to provide upskilling programs for working professionals can open up new revenue streams. - Partnerships with Schools and Governments

Byju’s can collaborate with schools and governments to offer blended learning solutions. By incorporating its content into school curriculums, it can reach a wider audience and create long-term partnerships that provide steady revenue streams. - Expansion into Corporate Training

The rising demand for corporate e-learning and employee training presents an opportunity for Byju’s to tap into this segment. By leveraging its content and technology, Byju’s could develop targeted training modules for businesses. - EdTech Innovations

Continued investment in AI and machine learning technologies will help Byju’s enhance its personalized learning algorithms. This can improve student outcomes, reduce dropout rates, and provide a more engaging and tailored experience.

Threats to Byju’s

- Intense Competition in the EdTech Space

The EdTech industry is highly competitive, with global players like Coursera, Khan Academy, and Unacademy offering similar services. Intense competition can lead to pricing pressures and a potential loss of market share for Byju’s. - Regulatory Challenges

Byju’s faces increasing regulatory scrutiny, particularly regarding its sales practices, student success rates, and advertising claims. Failure to comply with regulations could lead to fines, restrictions, and damage to its brand reputation. - Economic Slowdown and Consumer Spending

Economic slowdowns, particularly in emerging markets, can negatively impact consumer spending on educational tools and services. Byju’s premium pricing model may become a challenge in markets where affordability is a concern. - Technological Disruptions

Rapid technological advancements could disrupt Byju’s current business model. Competitors that innovate faster or offer better technological solutions may gain an edge over Byju’s, leading to a potential loss in market share. - Debt Overhang and Investor Confidence

Byju’s current financial strain and challenges in raising fresh capital pose a significant threat to its long-term growth. Failure to manage its debt efficiently could impact investor confidence, leading to a drop in its valuation and access to new funds.

Competitors of Byju’s

- Unacademy

A major competitor in India, Unacademy offers a wide range of learning content for school students, competitive exams, and professional development. Its live classes and community-based learning model differentiate it from Byju’s. - Vedantu

Vedantu is another Indian EdTech company that focuses on live tutoring sessions. Its focus on real-time interaction and personalized teaching has made it a strong competitor in the K-12 space. - Coursera

On the global stage, Coursera is a key competitor with its massive open online courses (MOOCs) that cater to students, professionals, and corporations. It offers accredited certifications and degrees from leading universities. - Khan Academy

Khan Academy offers free, high-quality educational content globally. Its philanthropic model and vast range of topics covered make it a popular alternative to Byju’s for budget-conscious students. - Toppr

Another competitor in the Indian market, Toppr focuses on K-12 education and competitive exam preparation. Its personalized learning platform and interactive features provide stiff competition to Byju’s.

Conclusion

Byju’s continues to be a dominant player in the EdTech industry, but it faces significant challenges, particularly concerning its financial health and regulatory compliance.

To maintain its leadership position, Byju’s must navigate the intense competition and capitalize on opportunities in international markets and skill-based learning.

By addressing its weaknesses and building on its strengths, Byju’s has the potential to sustain long-term growth and remain at the forefront of educational technology.

Frequently Asked Questions

1. What are Byju’s main strengths?

Byju’s strengths include strong brand recognition, a comprehensive digital learning platform, innovative learning tools, global expansion through acquisitions, and a scalable business model.

2. What challenges does Byju’s face?

Byju faces challenges such as high dependence on the Indian market, rising operational costs, criticism over aggressive sales practices, financial strain, and leadership instability.

3. What opportunities are available for Byju’s?

Byju can capitalize on growth in international markets, skill-based learning programs, partnerships with schools and governments, corporate training, and EdTech innovations.

4. Who are Byju’s main competitors?

Key competitors include Unacademy, Vedantu, Coursera, Khan Academy, and Toppr, all offering similar services in the EdTech space.

5. What are the threats to Byju’s?

Byju faces threats from intense competition, regulatory challenges, economic slowdowns, technological disruptions, and challenges in managing its debt.