Britannia Industries is one of India’s leading food companies, known for its extensive product portfolio, particularly in the biscuits, dairy, and bakery segments. The company continues to expand its market presence and innovate in the fast-moving consumer goods (FMCG) space.

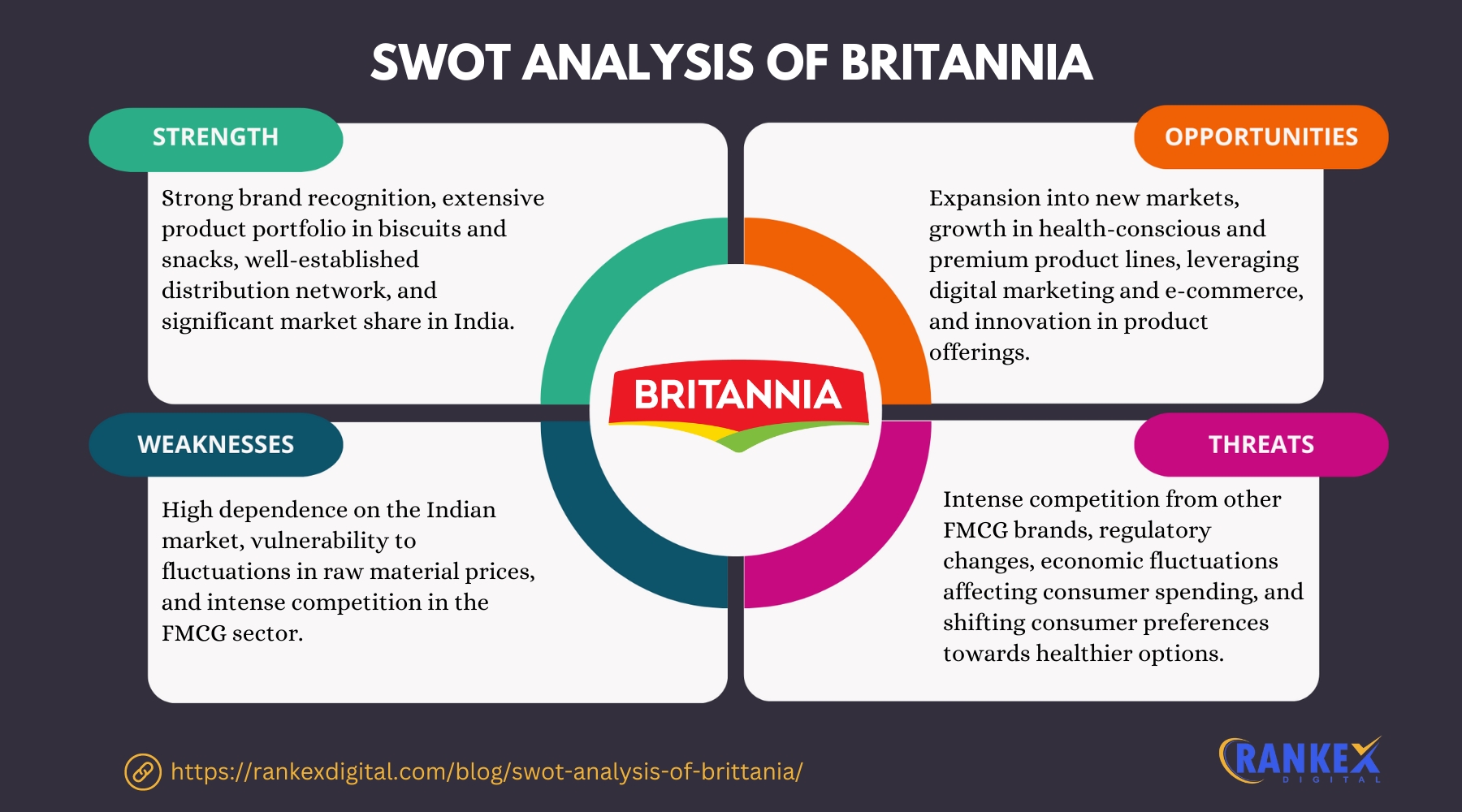

Here is an updated SWOT analysis of Britannia Industries.

Table of Contents

Overview of Britannia

| Founder | Nusli Wadia (Wadia Group) |

|---|---|

| Year Founded | 1892 |

| Origin | Kolkata, India |

| Industry | Food & Beverages, FMCG |

| Annual Revenue | $2.5 Billion (FY 2023) |

| Employees | 20,000+ |

Britannia is a household name in India and has built a strong reputation with iconic brands like Good Day, Tiger, Marie Gold, and Milk Bikis. The company is expanding its dairy and bakery segments while focusing on health-oriented products to meet changing consumer preferences.

Current News on the Market on Britannia

- Focus on Healthier Products: Britannia is responding to growing health-conscious trends by introducing products with lower sugar, higher fibre, and fortified ingredients, such as the NutriChoice range.

- Expansion into Dairy Segment: Britannia continues to expand its dairy business, leveraging the growing demand for value-added dairy products like cheese, yoghurt, and flavoured milk.

- New Plant Openings: Britannia has invested in expanding its manufacturing capacities with new plants in key locations, including an integrated food park in Ranjangaon, Maharashtra.

- Increased Export Focus: Britannia is targeting international markets, with a focus on exporting biscuits and dairy products to neighbouring countries and the Middle East.

- Sustainability Initiatives: The company is focusing on sustainable packaging and reducing its carbon footprint through energy-efficient manufacturing processes.

SWOT Analysis of Britannia

Strengths of Britannia

- Strong Brand Equity

Britannia is one of the most recognized and trusted FMCG brands in India. Its wide range of popular products across categories like biscuits, cakes, dairy, and bread strengthens its market position. - Extensive Distribution Network

Britannia’s vast distribution network spans urban and rural India, ensuring its products are available in both major cities and remote areas. This strong distribution capability gives it a competitive edge over smaller players. - Innovative Product Range

Britannia continuously innovates to meet evolving consumer tastes, offering a wide variety of biscuits, dairy products, and snacks, catering to different age groups and dietary needs. - Health-Focused Products

Recognizing the shift towards healthier eating habits, Britannia has introduced health-oriented product lines such as NutriChoice and NutriMilk. These products appeal to consumers seeking nutritious yet tasty food options. - Focus on Research and Development (R&D)

Britannia invests significantly in R&D to develop new products, improve existing offerings, and explore new markets. This continuous innovation keeps Britannia competitive in a fast-paced industry.

Weaknesses of Britannia

- Dependence on Biscuits Segment

Despite its expansion into dairy and other food categories, a significant portion of Britannia’s revenue still comes from its biscuit business. Over-dependence on this segment exposes the company to market saturation and competition from global players. - Limited Global Presence

While Britannia is expanding internationally, its global footprint remains relatively limited compared to other major FMCG players. This reduces its ability to capitalize on international market opportunities. - Pricing Pressure in Competitive Markets

The FMCG sector in India is highly competitive, with both domestic and multinational brands vying for market share. This intense competition often results in pricing pressures that could impact profitability. - Volatility in Raw Material Prices

Britannia’s profitability is affected by fluctuations in the prices of key raw materials such as wheat, milk, and sugar. These costs can be volatile due to factors like agricultural output, global commodity prices, and weather conditions. - Supply Chain Challenges

The company faces supply chain constraints, particularly in ensuring consistent quality and timely delivery of products across India’s vast geography, especially in rural areas.

Opportunities for Britannia

- Expansion in Dairy and Health-Focused Products

Britannia has an opportunity to significantly grow its presence in the value-added dairy segment and health-conscious product categories. Consumer demand for products like fortified biscuits, low-fat dairy items, and protein-rich snacks is on the rise. - International Market Expansion

Britannia can explore untapped markets in Africa, Southeast Asia, and the Middle East, where demand for Indian FMCG products is increasing. By focusing on exports, Britannia can diversify its revenue streams. - Product Innovation in Snacking and Bakery

With rising demand for convenient and on-the-go snacks, Britannia can introduce more innovative products in the snacking and bakery categories to capture a growing segment of consumers. - E-commerce and Digital Growth

As online shopping continues to surge in India, Britannia has an opportunity to strengthen its e-commerce presence, both through direct-to-consumer platforms and partnerships with leading online marketplaces like Flipkart and Amazon. - Sustainability and Eco-Friendly Practices

There is increasing consumer interest in environmentally responsible brands. Britannia can leverage this trend by adopting eco-friendly packaging solutions and reducing its carbon footprint, enhancing its brand appeal.

Threats to Britannia

- Intense Competition from Domestic and International Brands

Britannia faces stiff competition from both local FMCG players like Parle and ITC, as well as international brands such as Nestle and Mondelez. This competition can impact market share and profitability. - Regulatory and Health Challenges

Increasing scrutiny over food safety standards and health regulations, including potential taxes on high-sugar and high-fat products, could pose regulatory challenges and negatively affect Britannia’s product offerings. - Rising Raw Material Costs

Volatility in the prices of essential raw materials, such as wheat, milk, and edible oils, presents a risk to Britannia’s profitability, especially in a price-sensitive market like India. - Changing Consumer Preferences

As consumers shift towards healthier, organic, or plant-based products, Britannia may need to adapt its product portfolio to align with evolving dietary preferences. Failure to do so could result in a loss of market share. - Economic Slowdown

Economic downturns, inflation, or reduced consumer spending could lead to a decline in demand for Britannia’s products, especially in premium categories like high-end biscuits or value-added dairy products.

Competitors of Britannia

- Parle Products

One of Britannia’s biggest competitors in the biscuits and snacks category, Parle is known for its iconic Parle-G and Monaco brands, which enjoy significant market share in India. - ITC Ltd.

ITC is a formidable competitor in the FMCG sector, with a strong presence in biscuits (Sunfeast) and other food products like noodles, snacks, and dairy. - Nestle

Nestle competes with Britannia in the dairy, snacks, and bakery segments. Nestle’s Maggi, Milkmaid, and KitKat brands are strong contenders in the Indian market. - Mondelez International

Mondelez is a key competitor in the premium biscuits and snacks segment with its Oreo and Cadbury biscuit brands. It challenges Britannia in the premium and high-end biscuit market. - Haldiram’s

While Haldiram’s is primarily known for its savoury snacks, it competes with Britannia in the broader snacking market, particularly with its growing range of bakery and packaged food products.

Conclusion

Britannia remains a dominant force in the Indian FMCG sector, benefiting from strong brand equity, an extensive distribution network, and continuous product innovation.

However, challenges such as dependence on the biscuit segment, intense competition, and volatile raw material costs must be managed effectively.

By leveraging opportunities in the dairy, snacking, and health-conscious product categories, as well as expanding into new international markets, Britannia can continue to grow and strengthen its leadership position.

Frequently Asked Questions

1. What are Britannia’s main strengths?

Britannia’s main strengths include its strong brand equity, vast distribution network, and innovative product offerings, particularly in the biscuits and dairy segments.

2. What challenges does Britannia face in 2025?

Britannia faces challenges such as over-dependence on its biscuit business, competition from domestic and global brands, rising raw material costs, and supply chain complexities.

3. What are the growth opportunities for Britannia?

Britannia has growth opportunities in the expanding dairy segment, health-conscious product lines, snacking innovations, and digital and e-commerce channels.

4. How does Britannia compete with Parle and ITC?

Britannia competes with Parle and ITC by offering a diversified range of biscuits, snacks, and dairy products, along with strong brand loyalty and continuous innovation in its product portfolio.

5. What is Britannia’s focus on sustainability?

Britannia is focusing on sustainable packaging solutions and energy-efficient manufacturing practices to reduce its environmental footprint, enhancing its appeal to environmentally conscious consumers.