Asian Paints is India’s leading and one of the largest paint companies in the world, operating in the decorative and industrial coatings segments.

With a strong presence in the home décor and solutions space, the company has continuously expanded its product portfolio and geographical reach.

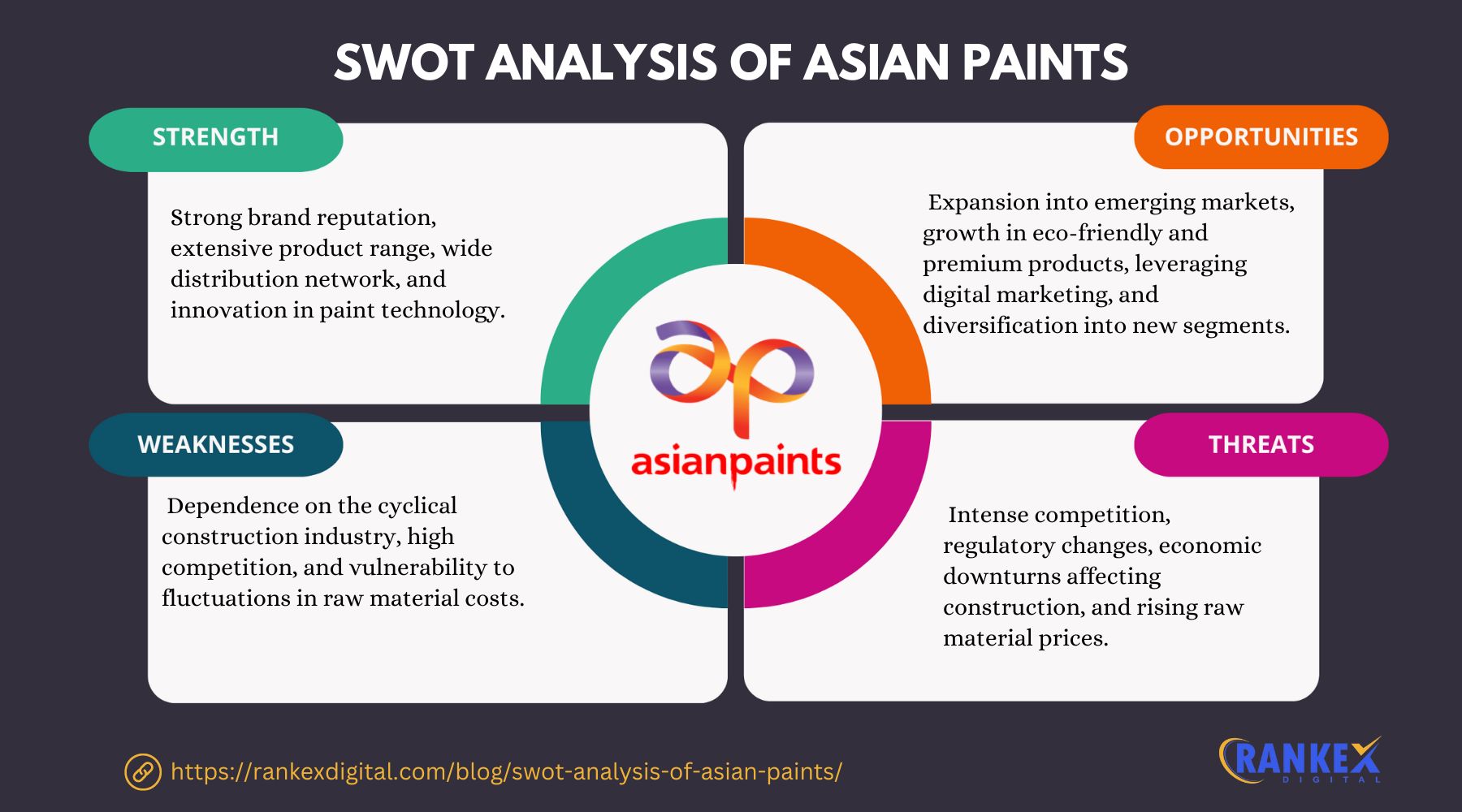

This SWOT analysis of Asian Paints delves into the company’s strengths, weaknesses, opportunities, and threats as it continues to dominate the paints and coatings market.

In this blog

Overview of Asian Paints

| Founder | Champaklal Choksey, Chimanlal Choksi, Suryakant Dani, and Arvind Vakil |

|---|---|

| Year Founded | 1942 |

| Origin | India |

| Industry | Paints and Coatings |

| Annual Revenue | $4.7 Billion (FY 2023) |

| Employees | 7,500+ |

Asian Paints specializes in the production and distribution of a wide range of decorative and industrial paints, coatings, and home improvement solutions. It operates in over 60 countries and has 26 manufacturing plants globally.

Current News on the Market on Asian Paints

- Expansion into Home Décor: Asian Paints continues to expand its portfolio beyond paints into home improvement and décor solutions, with offerings in furniture, furnishing, and bathroom fittings.

- Sustainability Initiatives: The company has undertaken several sustainability initiatives, including water conservation, reducing carbon emissions, and creating eco-friendly products to appeal to environmentally conscious consumers.

- Technological Advancements: Asian Paints is increasingly leveraging digital tools, including virtual color consultations and AI-driven interior solutions, to enhance customer experience and engagement.

- Inflationary Pressures: Rising input costs, especially in raw materials like crude oil and petrochemical derivatives, have impacted profitability, prompting the company to focus on cost optimization.

- Market Penetration in Tier 2 and 3 Cities: The company is focusing on increasing its market share in India’s tier 2 and 3 cities through targeted marketing strategies and product availability.

SWOT Analysis of Asian Paints

Strengths of Asian Paints

- Market Leadership

Asian Paints enjoys a dominant position in India’s paints and coatings market, commanding over 40% market share in the decorative segment. Its strong brand recognition and loyal customer base help maintain its leadership position. - Extensive Distribution Network

The company has one of the most extensive distribution networks in the industry, with over 70,000 dealers across India. This broad network ensures that its products are widely available, even in rural and semi-urban areas. - Diverse Product Portfolio

Asian Paints has a wide range of products catering to different segments of the market, including decorative paints, industrial coatings, and home décor solutions. This diversification reduces dependence on any single product line and enhances revenue streams. - Strong Focus on Innovation

The company has a strong focus on R&D, introducing innovative products such as weather-resistant paints, anti-bacterial coatings, and high-durability products. Its investments in technology help differentiate its offerings and meet evolving consumer needs. - Sustainability Commitment

Asian Paints is committed to sustainability, adopting eco-friendly practices, reducing its carbon footprint, and offering green products. This focus on sustainability strengthens its brand image, especially among environmentally conscious consumers.

Weaknesses of Asian Paints

- High Dependence on the Indian Market

Although Asian Paints operates in over 60 countries, a significant portion of its revenue comes from the Indian market. This over-reliance makes the company vulnerable to economic slowdowns or regulatory changes in India. - Rising Raw Material Costs

The company’s profitability is sensitive to fluctuations in the prices of raw materials, particularly petrochemical-based inputs. Recent inflationary pressures have impacted margins, forcing the company to increase prices or absorb costs. - Limited Global Penetration

While Asian Paints is a leader in India, its presence in international markets, especially developed regions like North America and Europe, remains limited compared to global competitors. This restricts its potential for rapid global growth. - Slow Adoption of Digital Channels

Though the company is working to improve its digital presence, it has been slow in adopting e-commerce and leveraging online sales platforms compared to other industries. This limits its ability to cater to a digitally savvy customer base. - Concentration in Decorative Segment

A large portion of Asian Paints’ revenue comes from decorative paints, leaving it exposed to market fluctuations and cyclical demand in the construction and real estate sectors. The company needs to strengthen its presence in industrial coatings and other non-decorative segments.

Opportunities for Asian Paints

- Expanding Home Décor Segment

Asian Paints has been diversifying into the home décor space with offerings like furniture, kitchen solutions, and bathroom fittings. This segment has strong growth potential, especially as more consumers seek integrated home improvement solutions from trusted brands. - Rural Market Penetration

There is immense potential for growth in India’s rural and semi-urban areas as disposable incomes rise. By tailoring its products and pricing strategies to these markets, Asian Paints can significantly boost its customer base. - Focus on Sustainable and Green Products

As environmental consciousness grows, there is an increasing demand for eco-friendly paints and coatings. Asian Paints can expand its green product portfolio and promote its sustainability initiatives to appeal to environmentally conscious consumers. - Growth in International Markets

With its strong brand and innovation capabilities, Asian Paints can explore further growth in emerging international markets in Africa, Southeast Asia, and the Middle East. Strategic acquisitions or partnerships could accelerate this expansion. - Digital Transformation

By enhancing its digital presence, including e-commerce platforms, virtual consultations, and AI-driven solutions, Asian Paints can create new revenue streams and engage with a tech-savvy customer base. There’s also potential in leveraging big data to understand customer preferences and enhance product offerings.

Threats to Asian Paints

- Intense Competition

Asian Paints faces stiff competition from both domestic players like Berger Paints and global giants such as PPG Industries and Sherwin-Williams. Increased competition can lead to pricing pressures, reducing profit margins. - Raw Material Price Volatility

Fluctuations in the prices of raw materials, particularly those derived from crude oil, can have a direct impact on production costs. The inability to pass on these costs to consumers could erode profit margins. - Economic Slowdown

Any slowdown in the real estate or construction sectors, which are key drivers for decorative paint demand, could adversely affect the company’s revenue. Similarly, broader economic downturns could reduce consumer spending on home improvement products. - Regulatory Risks

Stricter environmental regulations related to emissions, waste management, and hazardous materials could increase compliance costs. Additionally, changes in tax policies or trade regulations could affect profitability, especially in international markets. - Technological Disruption

The paint industry is increasingly seeing the adoption of new technologies, including smart coatings and self-cleaning paints. Failure to keep pace with such innovations could place Asian Paints at a competitive disadvantage.

Competitors of Asian Paints

- Berger Paints

Berger Paints is one of the leading competitors in the Indian decorative paints market, offering a wide range of products and consistently challenging Asian Paints’ market dominance. - Kansai Nerolac

Kansai Nerolac is another major player in the Indian market, known for its focus on industrial and automotive coatings in addition to decorative paints. - Dulux (AkzoNobel)

AkzoNobel’s Dulux brand is a global leader in paints and coatings, competing with Asian Paints in both decorative and industrial segments in India and abroad. - Sherwin-Williams

Sherwin-Williams, one of the largest paint companies globally, poses strong competition in international markets, particularly in North America and Europe, where Asian Paints has limited penetration. - PPG Industries

PPG Industries, a global leader in coatings, competes with Asian Paints in the industrial coatings segment. PPG’s strong presence in developed markets poses a challenge to Asian Paints’ global ambitions.

Conclusion

Asian Paints continues to dominate the Indian paints and coatings market with its market leadership, innovative product offerings, and strong distribution network.

The company is poised to explore new growth opportunities, particularly in the home décor and rural markets, while also focusing on sustainability and digital transformation.

However, challenges such as rising raw material costs, intense competition, and global market penetration need to be addressed for sustained growth.

Frequently Asked Questions

1. What are Asian Paints’ strengths?

Asian Paints’ strengths include market leadership in India, a diverse product portfolio, a strong focus on innovation, and a robust distribution network.

2. What are the weaknesses of Asian Paints?

Asian Paints’ weaknesses include high dependence on the Indian market, rising raw material costs, limited global penetration, and a slow digital transformation.

3. What opportunities does Asian Paints have in 2025?

Opportunities for Asian Paints include expanding into the home décor segment, penetrating rural markets, offering sustainable products, and growing in international markets.

4. What are the main threats to Asian Paints in 2025?

Asian Paints faces threats from intense competition, raw material price volatility, economic slowdowns, regulatory risks, and technological disruption.